Document Checklist

When applying for a mortgage, there are certain documents you need to provide. This guide outlines the required documents.

- Application Form

- Fully completed (pages 2, 3, 4, 5 & 6) and Signed (pages 7 & 8)

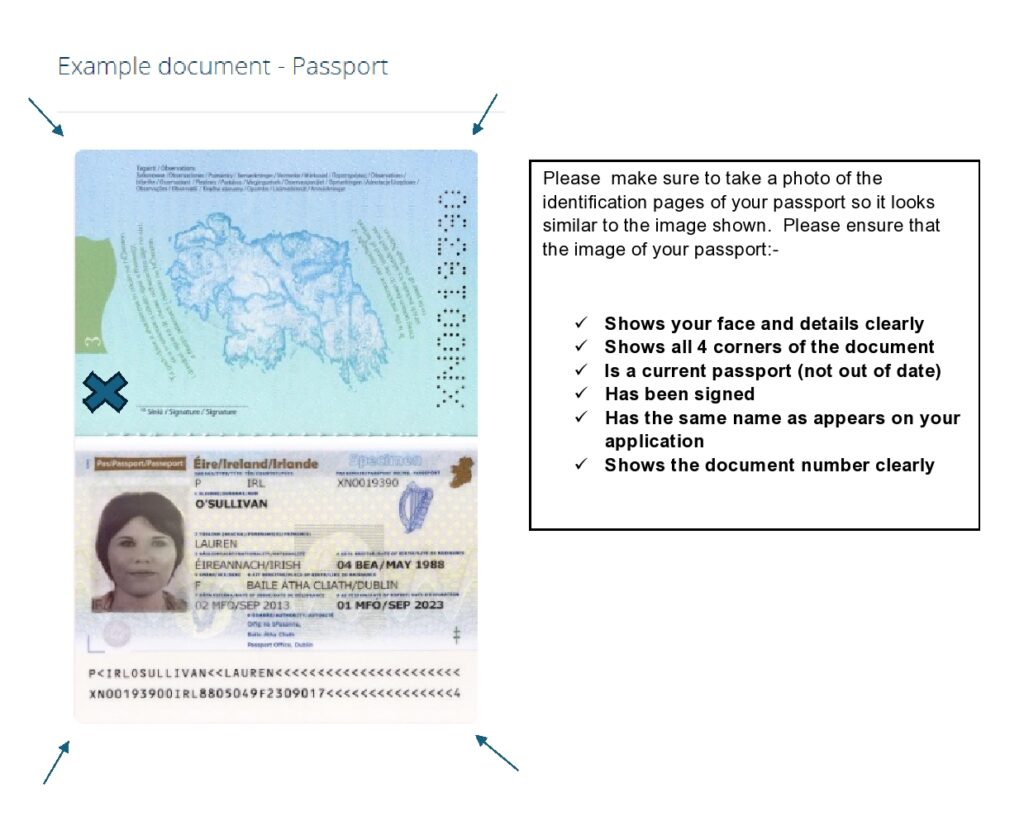

- Photo Identification & Proof of Address

- Current valid passport (must be in date and signed) or

- Current valid Irish, UK or European drivers Licence (must be in date and signed)

- Current Utility Bill or Bank Statement showing name and address

- Employment & Income Documents

(a) For Employee’s

- Attached Salary Certificate (stamped and signed by your employer)

- Employment Detail Summary (EDS)

Go to https://www.revenue.ie/en/jobs-and-pensions/end-of-year-process/employment-detail-summary.aspx

- Last 3 month’s payslip’s (if paid weekly or fortnightly must show full 3 months)

- If a tenant, evidence of rental payments or copy of tenancy agreement

- If you require a work permit/visa to work in Ireland, we require a copy of your IRP (Irish Residence Permit) – Stamp 4 Card (front and back).

(b) For Self Employed

- Last 3 Revenue Form 11’s and Chapter 4 confirmations

- Tax Clearance Certificate (business & personal) or confirmation from your accountant that tax affairs (business & personal) are fully up to date and that no significant changes have occurred in the business since the date of the last accounts.

- Last 3 years Audited/Trading accounts

- Landlords – copies of tenancy agreement.

- Financial Statements

- Last 6 months continuous Current Account Bank Statements

- Last 6 months continuous Savings Account statements

- Last 6 months continuous Credit Card statements (if applicable)

- Last 6 months continuous Loan statements (if applicable)

- Last 6 months continuous Revolut statements (if applicable)

- Last 12 months Mortgage Statements (if applicable)

- Separation or Divorce agreement (if applicable)

- If you have lived abroad within the past 3 years or have a bank account outside Ireland we require a foreign credit check from the relevant country in English

- When proposed mortgage is for a New Home, with stage payments or “self build” the following documentation is required:

- Costings template completed by Engineer or Architect

- Copy of (a) plans, (b) site map, (c) full and final planning permission

- Architects interim program sent as required

- Copy of architect/engineers’ professional indemnity insurance

- Certificate of compliance with planning permission

Very Important to Note

Until such time as your Mortgage is drawn down you must do the following:-

- Continue to Save

- Remain in current employment

- Don’t enter into any new financial commitments

- Advise of any changes in your circumstances which may affect your application

Please insure that you continue to keep statements and payslip’s as lenders may request them at any stage.

- Application Form

- Fully completed (pages 2, 3, 4, 5 & 6) and Signed (pages 7 & 8)

- Photo Identification & Proof of Address

- Current valid passport (must be in date and signed) or

- Current valid Irish, UK or European drivers Licence (must be in date and signed)

- Current Utility Bill or Bank Statement showing name and address

- Employment & Income Documents

(a) For Employee’s

- Attached Salary Certificate (stamped and signed by your employer)

- Employment Detail Summary (EDS)

Go to https://www.revenue.ie/en/jobs-and-pensions/end-of-year-process/employment-detail-summary.aspx

- Last 3 month’s payslip’s (if paid weekly or fortnightly must show full 3 months)

- If a tenant, evidence of rental payments or copy of tenancy agreement

- If you require a work permit/visa to work in Ireland, we require a copy of your IRP (Irish Residence Permit) – Stamp 4 Card (front and back).

(b) For Self Employed

- Last 3 Revenue Form 11’s and Chapter 4 confirmations

- Tax Clearance Certificate (business & personal) or confirmation from your accountant that tax affairs (business & personal) are fully up to date and that no significant changes have occurred in the business since the date of the last accounts.

- Last 3 years Audited/Trading accounts

- Landlords – copies of tenancy agreement.

- Financial Statements

- Last 6 months continuous Current Account Bank Statements

- Last 6 months continuous Savings Account statements

- Last 6 months continuous Credit Card statements (if applicable)

- Last 6 months continuous Loan statements (if applicable)

- Last 6 months continuous Revolut statements (if applicable)

- Last 12 months Mortgage Statements (if applicable)

- Separation or Divorce agreement (if applicable)

- If you have lived abroad within the past 3 years or have a bank account outside Ireland we require a foreign credit check from the relevant country in English

- When proposed mortgage is for a New Home, with stage payments or “self build” the following documentation is required:

- Costings template completed by Engineer or Architect

- Copy of (a) plans, (b) site map, (c) full and final planning permission

- Architects interim program sent as required

- Copy of architect/engineers’ professional indemnity insurance

- Certificate of compliance with planning permission

Very Important to Note

Until such time as your Mortgage is drawn down you must do the following:-

- Continue to Save

- Remain in current employment

- Don’t enter into any new financial commitments

- Advise of any changes in your circumstances which may affect your application

Please insure that you continue to keep statements and payslip’s as lenders may request them at any stage.